When it comes to Blockchain technology, it’s hard to see the wood for the trees of Bitcoin and the cryptocurrency ‘bubble’. In fact, the speculation around Bitcoins may very well be the reason why all the other possible uses of Blockchain technology haven’t yet transformed our everyday lives. After all these years of science fiction developments around the multiple ways Blockchain will change our lives, one may wonder why we’ve moved so slowly and no “revolution” seems yet to be underway. That could be because “the cryptocurrency bubble is strangling innovation”, writes journalist Jon Evans in TechCrunch: the speculative values of cryptocurrencies are “precluding any non-speculative uses”. Thus the whole continent of the Blockchain ecosystem is still in “hibernation”…

Yet a large part of the non-speculative uses of Blockchain technology have the potential to transform the world of work profoundly, improve how labour markets work, increase transparency and equality, empower smaller parties…basically address some of the biggest challenges in today’s and tomorrow’s world of work. Provided the speculative bubble bursts and / or we find ways to scale the technology so that transaction fees fall sharply, Blockchain technology makes diverse uses possible that are so promising that they may overshadow the negative discussions around technology and work that dominate our media landscape. Let’s explore here some of the technology’s potential implications for the future of work.

Why the Blockchain can transform how we run organisations and how we structure them

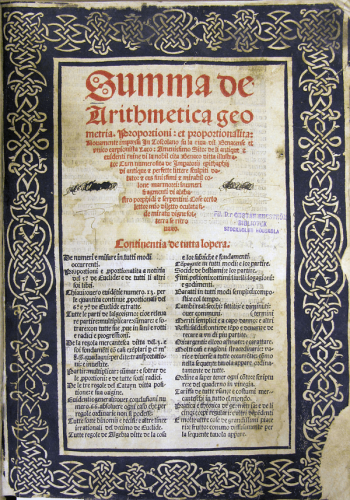

Although accounting is said to have been invented more than 7,000 years ago in Mesopotamia, we owe our ‘modern’ double-entry system of book-keeping to the 15th-century mathematician and Leonardo Da Vinci acolyte named Luca Pacioli, a Venetian now best remembered for his Summa de Arithmetica, Geometria, Proportioni et Proportionalità published in 1494, that includes the world’s very first treatise on book-keeping. We owe him most of the symbols still in use today, as well as the accounting cycle as we know it today. Pacioli is said to be “the Father of accounting”: he invented what would become balance sheets and income statements.

The invention did not only lead to the development of professional accountants. It was a long-lasting revolution that enabled trade, investment in other entities, taxation, the creation of the modern state, the development of public services…and a large number of activities and services we take for granted today.

In many ways, record-keeping has not changed significantly since then. Today, a whole class of certified and trusted professionals is still trained to keep records, enforce contracts, and validate transactions, more or less the same way as in 15th-century Venice. Because paperwork is expensive, corruptible and open to interpretation, this class of professional intermediaries is absolutely critical. There could be no trusted contracts and transactions without them.

And yet they could soon be replaced by technology. Many prophetise that blockchain technology will be the “most significant advancement in record-keeping” since the invention of accounting. As the “only incorruptible ledger” mankind has created, it has the potential to reshape how we structure and run organisations. A ledger that has no ownership, that is shared publicly, distributed among thousands of computers and continually reconciled, a blockchain does away with the need for middlemen to enforce compliance. Unlike traditional records that can be manipulated by unscrupulous bureaucrats, or forged by dishonest parties, with blockchain technology there is no central database for attackers to corrupt. (See Wikipedia: “a blockchain is a continuously growing list of records, called blocks, which are linked and secured using cryptography. Each block typically contains a hash pointer as a link to a previous block, a timestamp and transaction data. By design, a blockchain is inherently resistant to modification of the data.”)

No powerful intermediary is required to authenticate blockchain transactions. With the use of state-of-the-art cryptography, there can be global, distributed databases that can record the fact that a transaction has been made. It can also record any type of structured information, including anything related to authentication and trust. Thus the very raison-d’être of a number of professions—lawyers, solicitors, notaries, chartered accountants…—will be (at least partly) challenged. One can easily imagine the transformational power of such technology: it can make transnational transactions safer, facilitate contracting between various entities, and ultimately it could render the old theory of the firm somewhat obsolete (and firms themselves).

How regulated professions may be challenged and what it means for individual workers

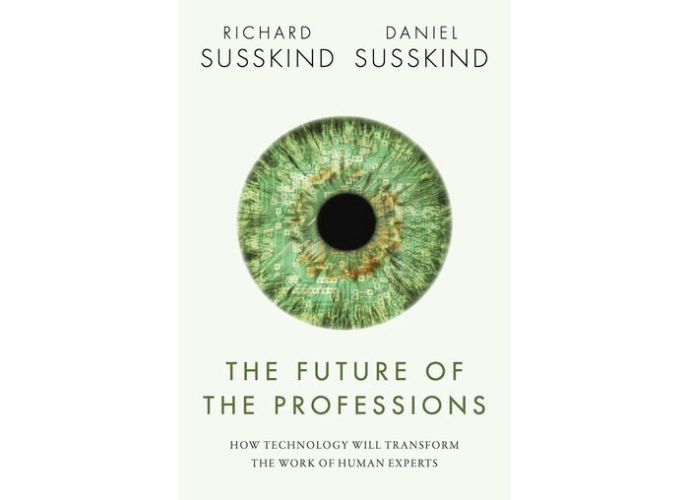

In their ground-breaking book titled The Future of the Professions (see my summary of their book here), Richard and Daniel Susskind argue that AI and platforms are challenging the future relevance of the professions as we know them. Though the authors do not mention the role of blockchain technology in particular, what they write certainly applies to its consequences on the relevance of professional work. Some of these professions were built on the necessity to establish trust between contracting parties and enforce the contract. And this particular technology makes this aspect of their work irrelevant.

We granted these professions some form of monopoly so as to ensure their trustworthiness. Richard and Daniel Susskind call this the “Grand Bargain” of the professions. We also granted them some kind of exclusivity over their activities for the protection of the public and to make our system of transactions trustworthy. We give solicitors, notaries, lawyers, chartered accountants and other professionals the mission to validate and authenticate our contracts and transactions. And we have protected their professions to prevent quacks and charlatans from corrupting trust. This is how the authors of the book explain it:

“In acknowledgement of and return for their expertise, experience, and judgement, which they are expected to apply in delivering affordable, accessible, up-to-date, reassuring, and reliable services, and on the understanding that they will curate and update their knowledge and methods, train their members, set and enforce standards for the quality of their work, and they will only admit appropriately qualified individuals into their ranks, and that they will always act honestly, in good faith, putting the interests of clients ahead of their own, we (society) place our trust in the professions in granting them a fair wage, by conferring upon them independence, autonomy, rights of self-determination and by according them respect and status”.

But the terms of this bargain are now antiquated. Technology can make at least some of these services more affordable and more accessible. And in the case of blockchain technology, it can make some services fully irrelevant. The very existence of these professions has long had some sort of bottleneck effect. Many people can’t afford the services of these professionals. Access is necessarily limited. Therefore if disintermediation can be made possible with restored trust, then these professions may be partly challenged… and individuals could be empowered to enter contracts without the usual cost and deterrent bottleneck red tape. In the case of very small companies (composed of one individual freelancer), the liberating potential could be unprecedented.

Is Ethereum the way of the future of work?

The Ethereum platform is all the rage these days (even ratings agencies are beginning to get interested). An “open-source, public, blockchain-based distributed computing platform” (Wikipedia), Ethereum allows to write “smart contracts” that enforce the rules about how value is to be transferred between parties. It can also provide a new operating system for an organisation to record the terms of all its agreements. Its disruptive power is therefore considerable: it is said to “upend and disintermediate the established order”. How can it transform work?

Ethereum creates immutable records of what happened and who was involved without the need for intermediaries to authenticate it. It makes the execution of complex agreements that will automatically be enforced. So naturally it has applications in payroll services: for example, Bitwage, launched in 2015, released a app for employees and freelancers to receive their wages in Bitcoin without requiring their employers or clients to sign up. It is popular with remote freelancers spread across the globe: a significant part of its users find that it makes international transactions easier.

With the Ethereum platform, entrepreneurs can “incentivize people to participate in networks that organize into new types of businesses”. A whole new ecosystem of applications can be imagined to offer new ways of attracting, compensating and managing talent. Its potential to transform HR has not gone unnoticed: see this blog post by Deloitte that explores “four HR blockchain examples that aim to change the way we perform core HR processes including payroll, recruitment, competency management and learning”. (For example, digital CVs verified and cemented into Blockchain could transform sourcing and hiring for HR professionals).

The possible services that companies and governments can develop using Ethereum have also the potential to transform how we work, consume and pay taxes. One need only look at the services “e-Estonia” is already offering to get an idea of the transformative power of blockchain technology. Several governments, among which the UK, are now exploring how welfare, social protection and taxes can be streamlined with such technology.

The benefits of Blockchain seem prodigious: a few more examples for the road

Blockchain technology is generally expected to bring about a more transparent and fairer world. Open ledgers could produce more transparency in wages, which would make it easier to align pay with quantifiable performance. Therefore it could help advance equal pay and equal opportunities at work. The gender pay gap is a complex multi-factor subject, as you can read in our article here, but this technology could help at least with the most blatant cases of active discrimination.

Also, labour markets and the relationships between employers and employees could be redefined. For a long time short-term engagements and gig contracting have suffered from a problem of payment security. Freelancers have long complained that getting paid was one of their most critical problems. As explained in this HBR article, “over 70% of freelancers have trouble getting paid at some point in their careers, according to research by the Freelancers Union, the nonprofit group that promotes the interests of independent workers”. Freelancers suffer from a fundamental power imbalance, their paycheck doesn’t always come on time. A new blockchain-based payment and contract system would empower them further.

Last but not least, smart contracts are expected to facilitate self-organisation. They are said to have the potential to transform management and the organisation of work as we know them… The discussion of technology and the future of work is too often dominated by the idea of automation and job destruction. But blockchain technology is associated to numerous ground-breaking and life changing applications that can empower workers and make the world of work better, more transparent, safer, more equal and more effective. Too bad we’ll have to wait for the Bitcoin rage to calm down for those developments to happen…

A lire aussi sur la data

Cloud Computing, de la propriété à la consommation

De la propriété à la consommation “on demand” ? La notion de propriété, d’actif financier, a longtemps rassuré l’entrepreneur et les actionnaires. Posséder son système

Data For Good

La Data For Good, si on devait en donner une définition simple, c’est l’apport de la data science comme leviers d’innovation for good pour la société